April 2025 IICLE FLASHPOINTS

APRIL 2025 FOCUS AREAS

Criminal Law

Fourth District Reverses DUI Conviction Due to Improperly Conducted Stipulated Bench Trial

by Matthew R. Leisten

Employment & Labor

Illinois Joins Other States in Eliminating Sub-Minimum Wage Payments to Persons with Disabilities

by Thomas C. Garretson

Family Law

Reviewable Maintenance Reversed Due to Permanent Maintenance Being Warranted and More

by Michelle A. Lawless

Spotlight

Get a sneak peek at what makes the 2025 Estate Planning Short Course a can’t-miss event for estate planning attorneys. In a special podcast episode, program co-chairs Lorraine Cavataio and Stacy Singer share highlights, insights, and what attendees can expect from this year’s powerful two-day lineup. Listen now and get ready to join us in Champaign or Chicago!

Read Full SpotlightFEATURED HANDBOOKS

FLASHPOINTS is a complimentary monthly newsletter featuring current legal updates and trending topics in various practice areas. IICLE®, a 501(c)(3) non-profit organization, produces materials like these to support the career growth of Illinois legal professionals. Thank you to our contributors, sponsors, and readers. For information about becoming an IICLE® contributor, please find resources located here.

Criminal Law

Fourth District Reverses DUI Conviction Due to Improperly Conducted Stipulated Bench Trial

In People v. Gonzalez, 2025 IL App (4th) 240384, the Fourth District Appellate Court reversed the defendant’s DUI conviction that was imposed after a stipulated bench trial because it was improperly conducted as a trial.

In Gonzalez, the defendant was initially cited for failure to reduce speed to avoid an accident and failure to report an accident. The defendant consented to chemical testing during the investigation, and she pleaded guilty to the charges a month after the accident. The investigating deputy then received an Illinois State Police (ISP) crime laboratory report after the defendant had pleaded guilty that showed her blood alcohol content was over 0.08. 2025 IL App (4th) 240384 at ¶¶5 – 6.

The defense filed a motion to dismiss for double jeopardy, and the deputy testified about the investigation, including receiving the ISP lab report and charging the defendant with DUI. The trial court denied the motion, and the parties proceeded to a stipulated bench trial before another judge on a subsequent court date. 2025 IL App (4th) 240384 at ¶¶6 – 7.

The stipulated bench trial consisted only of the new trial judge taking judicial notice of the motion to dismiss the transcript. No exhibits were admitted, and no arguments were made by the parties. The defendant was found guilty of DUI. 2025 IL App (4th) 240384 at ¶10.

The appellate court reversed and criticized how the stipulated bench trial was conducted. The appellate court noted that the only “evidence” at the trial was the transcript of the deputy’s testimony. 2025 IL App (4th) 240384 at ¶20. The appellate court concluded that the deputy’s testimony from the hearing did not establish that the defendant was the driver of the vehicle that was in the accident. The deputy had testified that he had “reason to believe” that she was the driver based on statements made by her passengers. 2025 IL App (4th) 240384 at ¶6. However, the appellate court stated that those statements were hearsay and thus could not be used as evidence against her. 2025 IL App (4th) 240384 at ¶¶17, 22 – 25.

The appellate court also rejected the state’s argument that the defendant’s guilty pleas to the traffic citations were judicial admissions that she was driving because those convictions were never admitted as evidence. Although the convictions were referenced in the hearing and stipulated trial, they were never admitted as evidence in either proceeding. 2025 IL App (4th) 240384 at ¶20.

The appellate court also held that the state failed to show that the defendant was under the influence of alcohol. The deputy had testified that the defendant did not show signs of intoxication at the scene and he requested that she consent to testing only because the other occupants were injured. The state also never admitted the ISP lab report into evidence during the hearing, nor were the results stated on the record. The deputy’s testimony showed only that he issued the DUI citations after he received the report. 2025 IL App (4th) 240384 at ¶¶29 – 30.

The appellate court emphasized that parties should always treat a stipulated bench trial as a trial even though it is an abbreviated one. The appellate court criticized the trial court for not reviewing the transcript that was the basis for the stipulation. Since the defendant did not stipulate sufficiency of the evidence and the evidence that was stipulated to was insufficient to establish that she was DUI, her conviction was reversed. 2025 IL App (4th) 240384 at ¶¶34, 36.

For more information about criminal law, see CRIMINAL RECORDS: EXPUNGEMENT AND OTHER RELIEF (IICLE®, 2024). Online Library subscribers can view it for free by clicking here. If you don’t currently subscribe to the Online Library, visit www.iicle.com/subscriptions.

Employment & Labor Law

Illinois Joins Other States in Eliminating Sub-Minimum Wage Payments to Persons with Disabilities

On January 21, 2025, Governor Pritzker signed into law the Dignity in Pay Act, P.A. 103-1060. In doing so, Illinois joined 18 other states that have eliminated, phased out, or modified the legal authority of employers to pay sub-minimum wages to people with disabilities.

Section 14(c) of the Fair Labor Standards Act of 1938 (FLSA), ch. 676, 52 Stat. 1060, legally permits the employment of individuals with disabilities at wage rates below the federal minimum wage if the person’s disability impairs the worker’s earning or productivity capacity for the work being performed. See 29 U.S.C. §214(c). Data provided by the U.S. Department of Labor in October 2022 reflects that Illinois ranks second in the United States in the number of §14(c) wage certificates issued or pending. Under the Dignity in Pay Act, however, all §14(c) wage certificates expire on December 31, 2029, and no certificates may be issued after that date.

The Act requires, by no later than July 1, 2025, the Employment and Economic Opportunity for Persons with Disabilities Task Force to create a multi-year plan of recommended actions, outcomes, and benchmarks to help the state successfully eliminate the use of §14(c) wage certificates on and after December 31, 2029. 20 ILCS 4095/16. The multi-year plan is required to include (1) identification, gathering, and analytics of data to inform the Task Force’s work; (2) recommended actions to assist providers in employing people with disabilities; (3) recommended measurable outcomes for each year of the plan; and (4) recommended benchmarks for each year of the plan. 20 ILCS 4095/16(1). In developing the multi-year plan, the Task Force is required to consider various factors and consult with a number of designated groups. The Task Force is required to submit annual reports on implementation of the multi-year plan to the Governor and the General Assembly no later than January 1 of each year through 2030. 20 ILCS 4095/16(4).

The Act also amends the Department of Human Services Act, 20 ILCS 1305/1-1, et seq., to direct the Department of Human Services (DHS) to establish a §14(c) transition program to award grants to eligible community agencies with active or pending §14(c) certificates to aid in the transition away from paying sub-minimum wages to workers with disabilities. 20 ILCS 1305/1-95. Eligibility for the program grants is contingent upon community agencies submitting transition plans. DHS shall make grants to eligible §14(c) certificate holders to assist workers with disabilities who are working for sub-minimum wages to transition to competitive integrated employment. The grant funding is to be used to (1) provide competitive integrated employment; (2) assist individuals with disabilities who were employed at sub-minimum wages to find and retain competitive integrated employment; or (3) provide integrated community participation and wrapround services for individuals with disabilities who were employed at sub-minimum wage. 20 ILCS 1305/1-95(c).

Employers with §14(c) wage certificates must begin planning now for the eventual elimination of the minimum wage exception in 2030.

For more information about employment and labor law, see CAUSES OF ACTION: EMPLOYMENT ACTIONS (IICLE®, 2024). Online Library subscribers can view it for free by clicking here. If you don’t currently subscribe to the Online Library, visit www.iicle.com/subscriptions.

Family Law

Reviewable Maintenance Reversed Due to Permanent Maintenance Being Warranted and More

Reviewable Maintenance Reversed Due to Permanent Maintenance Being Warranted

In Biangardi v. Biangardi, 2025 IL App (1st) 221559-U, when the pretrial litigation lasted almost five years, the wife, who represented herself at trial, appealed the trial court’s award of two-year reviewable maintenance in the amount of $4,500 per month. 2025 IL App (1st) 221559-U at ¶2. The appellate court reversed, finding the case a “classic” example warranting permanent maintenance. 2025 IL App (1st) 221559-U at ¶37. The parties were married for 27½ years, during which the wife was a stay-at-home mom with a GED and no college degree. She had no employment history and was recently earning $12 per hour as a cashier. 2025 IL App (1st) 221559-U at ¶14. The husband owned multiple businesses during the marriage, and it was undisputed that the parties had lived a lavish lifestyle historically, although the husband’s businesses had gone through a downturn. The trial court was also upheld on the 50-50 division of marital assets, ordering two homes and ancillary business assets sold, and the barring of the wife’s untimely expert testimony and report and exhibits. The wife failed to produce her expert report or her exhibits in accordance with the trial court’s trial order. The court noted the wife had appeared pro se at trial after being represented by six law firms throughout the pretrial litigation and reiterated the well-settled principle that self-represented litigants are held to the same standards as counsel.

Language in Marital Settlement Agreement Limited Payout on Deferred Compensation to Marital Payments Only

The First District affirmed the trial court’s interpretation of a marital settlement agreement (MSA) provision requiring the ex-husband to pay the ex-wife 50 percent of future deferred compensation distributions received from his former employer. In re Marriage of Zisook, 2025 IL App (1st) 221834-U, ¶1. The court held the MSA unambiguously limited the ex-wife’s 50 percent to deferred compensation that was marital property, funds earned during the marriage and paid out post-dissolution. The dispute arose over three payments received in 2018 and 2019 totaling $390,158, which the ex-husband argued were nonmarital because they were earned after the dissolution. 2025 IL App (1st) 221834-U at ¶6. The trial court found the 2018 payment was based on 2015 employment (during the marriage) and thus marital, but because the 2019 payments stemmed from post-dissolution compensation, they were nonmarital. The appellate court affirmed, finding the trial court’s ruling consistent with contract interpretation principles and not against the manifest weight of the evidence. Part and parcel to the decision was the fact the court rejected the ex-wife’s argument that the MSA language that “any” future deferred compensation included nonmarital payments, reasoning such a reading would nullify other provisions limiting the agreement to marital assets.

Trial Court’s Imputation of Income to Husband for Child Support Purposes Upheld, Including Several Issues Pertaining to Nonmarital Property

The appellate court affirmed the trial court’s rulings on several key issues involving imputed income and nonmarital property characterization in In re Marriage of Ibrahim, 2025 IL App (1st) 230146-U. The trial court properly imputed $7,500 in monthly income to the husband. 2025 IL App (1st) 230146-U at ¶4. He failed to produce credible evidence of his income through documentation and testified his income was between $3,000 and $12,000 per month. 2025 IL App (1st) 230146-U at ¶¶4, 5, 19. Child support was set at $188 per month, which was upheld along with shared children’s expense obligations. 2025 IL App (1st) 230146-U at ¶34. The wife claimed interest in two nonmarital LLCs, which was also upheld given the evidence showed both were capitalized solely with gifts from her father and never commingled with marital assets. The husband claimed ownership in one LLC due to being the registered agent and managing member in the articles of incorporation. However, because he was not listed as an owner in the operating agreement, he did not hold an ownership interest. Pursuant to the Limited Liability Company Act (LLCA), 805 ILCS 180/1-1, et seq., a company’s operating agreement, not its articles of organization, dictates membership in an LLC.

For more information about family law, see ADOPTION LAW (IICLE®, 2024). Online Library subscribers can view it for free by clicking here. If you don’t currently subscribe to the Online Library, visit www.iicle.com/subscriptions.

Real Estate Law

First District Holds Illinois’ Rental Housing Support Program Does Not Obligate Landlord To Show Good Cause in Deciding Not To Renew Tenant’s Lease

Many landlords and tenants rely on funds from Illinois’ Rental Housing Support (RHS) Program, which provides rental assistance payments to landlords, thereby establishing more affordable housing stock in Illinois for low-income tenants. 310 ILCS 105/5. While relevant Illinois administrative regulations require landlords to have “good cause” before they may evict a tenant receiving subsidized rental payments, the First District in Ventus Holdings, LLC v. Raddle, 2025 IL App (1st) 241169, ¶1, recently addressed whether the “good cause” requirement also applies when landlords refuse to renew a tenant’s lease.

Facts

Ventus Holdings, LLC (Ventus) entered into a lease with Harold Raddle to rent a unit subsidized by funds from the Illinois RHS program. 2025 IL App (1st) 241169 at ¶2. Four months prior to the end of Raddle’s lease term, Ventus served him with a written 120-day notice of termination, informing him that his lease would not be renewed after its expiration date at the end of July. 2025 IL App (1st) 241169 at ¶3. The notice did not state any reason why Ventus was declining to renew the lease. Id. Notwithstanding receipt of the notice, Raddle did not timely vacate his unit but instead attempted to pay his August rent after the lease term had expired, which Ventus promptly returned to him. 2025 IL App (1st) 241169 at ¶4. Later that same month, Ventus filed its eviction action against Raddle. 2025 IL App (1st) 241169 at ¶5.

Raddle initially moved for summary judgment, arguing that Ventus could decline to renew his lease only for “good cause,” citing various RHS-related regulations requiring good cause to evict. Id. Because Ventus did not give a reason for refusing to renew Raddle’s lease, Raddle contended that his landlord was in violation of the regulations and that summary judgment should be granted in his favor on Ventus’s eviction action. Id. The trial court denied Raddle’s motion. 2025 IL App (1st) 241169 at ¶6. In responding to Ventus’s complaint, Raddle raised the affirmative defense of waiver, arguing that because Ventus accepted eight months of rental payments post-termination without returning them to Raddle, Ventus forfeited its right to terminate the lease based on its prior termination notice. Id.

At the bench trial, Ventus argued that there was no waiver of its termination of Raddle’s lease. 2025 IL App (1st) 241169 at ¶¶7 – 9. Specifically, although Raddle had directly deposited eight months of payments into Ventus’s bank account, he did not identify the deposits as his, and, as a result, Ventus had no way to connect the deposits with Raddle and the payments were never applied to Raddle’s account. Id. As soon as Ventus was informed that the unapplied payments related to Raddle, Ventus immediately refunded the money to him, as Ventus had done with his initial attempt to pay August rent shortly after his lease had expired. Id.

Because Ventus was unaware of Raddle’s payments until shortly before trial, the lower court found that it had not waived its right to maintain its eviction action against Raddle and entered an eviction order against him. 2025 IL App (1st) 241169 at ¶10. The trial court denied Raddle’s motion to reconsider and stayed the eviction order pending his timely appeal. Id.

Appellate Court

On appeal, Raddle argued that the trial court erred in denying his motion for summary judgment because 47 Ill.Admin. Code §380.506 provides that a landlord must have “good cause” not to renew a tenant’s lease of a unit subsidized under the RHS program. 2025 IL App (1st) 241169 at ¶¶11 – 12. Because Ventus did not state any cause why Raddle’s lease was not renewed, Raddle argued that Ventus’s actions were invalid and he should not have to vacate his unit. Id. The appellate court disagreed, upholding the lower court’s decision after taking a deep dive into interpreting §380.506, as well as other relevant regulations, statutes, and ordinances. 2025 IL App (1st) 241169 at ¶¶13 – 19.

Specifically, §380.506 provides the following: “Landlords shall have the right to evict Tenants from Units for good cause, as permitted under State and local law.” 2025 IL App (1st) 241169 at ¶14. No mention is made of any conditions or restrictions imposed on landlords regarding lease renewals. Giving effect to the clear and unambiguous language of the entirety of the regulation, the appellate court noted that Raddle’s “construction would require us to add language to section 380.506 that is not there, as nothing in section 380.506 converts a fixed-term lease into an indefinite one that does not expire unless good cause is shown for nonrenewal.” Id. The appellate court continued by recognizing that “[u]nder familiar rules of statutory construction, we may not add words to the regulation or fill in perceived omissions.” Id.

Raddle further argued that his construction of §380.506 comported with the “purpose of the RHS program . . . to provide stability for residential tenants by supplying ‘decent, affordable, permanent rental housing.’ ” 2025 IL App (1st) 241169 at ¶15, citing 310 ILCS 105/5, and 47 Ill.Admin. Code §380.102. By interpreting §380.506 to allow for indefinite leases, Raddle argued that the RHS program would enable tenants to “achieve the financial and housing stability at the heart of the program.” 2025 IL App (1st) 241169 at ¶15.

Once again, the appellate court disagreed, pointing to 47 Ill.Admin. Code §380.104, which provides that regulations governing the RHS program “shall be construed in conformity and compliance with applicable federal and State law.” 2025 IL App (1st) 241169 at ¶16. Illinois law does not provide that residential leases automatically renew or extend indefinitely and allows a landlord to evict if a tenant does not timely move out once a lease has expired. Id. Similarly, Chicago Municipal Code §5-12-130(j)(3) allows a landlord to provide written notice of a landlord’s intent not to renew a lease, as Ventus did with Raddle. Id. The appellate court further remarked that “Sections 380.307 and 380.502 [of the Code] indicate that properties for which rental assistance is provided under the RHS program are, in fact, subject to renewable (not indefinite) leases that may be terminated by the landlord.” 2025 IL App (1st) 241169 at ¶17. Finally, Raddle’s focus on the Illinois Housing Development Authority’s model lease document provided no support for his “good cause” argument, as the provisions of the model lease merely restated §380.506’s language in the eviction context. 2025 IL App (1st) 241169 at ¶18.

Ultimately, the appellate court found that “landlords in the RHS program are required to show good cause under section 380.506 only when evicting a tenant, not when making a renewal decision.” 2025 IL App (1st) 241169 at ¶19. In contrast, Ventus had “good cause” to evict Raddle after he refused to leave his unit after timely receipt of Ventus’s nonrenewal notice pursuant to Chicago Municipal Code §5-12-130(j)(3). Id. As a result, the lower court committed no error in denying Raddle’s motion for summary judgment. Id.

The appellate court then turned its attention to Raddle’s second issue on appeal: whether the trial court erred in finding Ventus had waived its termination of Raddle’s lease and therefore could not pursue its eviction action. 2025 IL App (1st) 241169 at ¶20. While the Illinois Supreme Court has repeatedly held that any act of a landlord affirming the existence of a lease and recognizing a tenant as a continued lessee (e.g., by accepting rental payments post-termination) can waive a landlord’s right to terminate the lease, the appellate court upheld the trial court’s determination that no landlord waiver had occurred with respect to Raddle. 2025 IL App (1st) 241169 at ¶21, citing Avdich v. Kleinert, 69 Ill.2d 1, 370 N.E.2d 504, 12 Ill.Dec. 700 (1977), and Midland Management Co. v. Helgason, 158 Ill.2d 98, 630 N.E.2d 836, 196 Ill.Dec. 671 (1994). Here, the landlord was unaware that the payments came from Raddle until right before trial and, upon learning of the payments, immediately wrote a check to Raddle reimbursing those payments; therefore, no waiver occurred. Id. Under these particular facts, Ventus performed no act that recognized the continued existence of Raddle’s lease. Id.

For more information about real estate law, see MORTGAGE FORECLOSURE: CORRESPONDING ISSUES (IICLE®, 2024). Online Library subscribers can view it for free by clicking here. If you don’t currently subscribe to the Online Library, visit www.iicle.com/subscriptions.

Workers’ Compensation

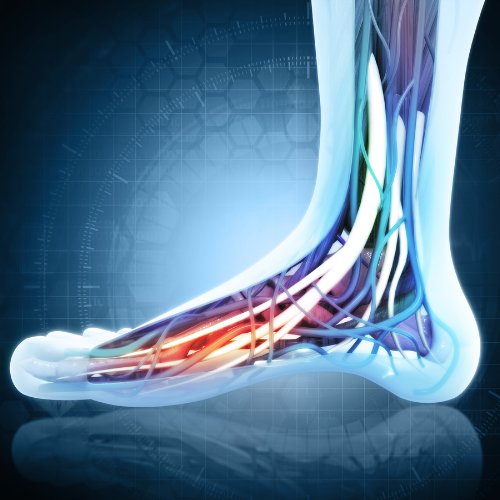

Fourth District Rules Foot Qualifies as Part of Leg for Disfigurement Benefits Under Workers’ Compensation Act

In Panda Express, Inc. v. Illinois Workers’ Compensation Commission, 2025 IL App (4th) 240771WC-U, the Workers’ Compensation Division of the Illinois Appellate Court reversed the decision of the circuit court of Boone County and reinstated the decision of the Commission.

The claimant on September 25, 2018, was training new workers on how to properly transfer hot oil from the fryer to the disposal area. 2025 IL App (4th) 240771WC-U at ¶8. The hot oil spilled onto the claimant’s feet, primarily onto his left foot and ankle. It also splashed onto his right foot.

The claimant was treated for his burns, which were assessed to be at the third degree. The claimant was hospitalized through October 9, 2018. 2025 IL App (4th) 240771WC-U at ¶12. At discharge, his final diagnoses were a third-degree burn of multiple sites of the left ankle and foot, a second-degree burn of multiple sites of the right ankle and foot, and cellulitis of the left lower limb.

The claimant was treated through May 8, 2019, and was thereafter released to return to work full duty. 2025 IL App (4th) 240771WC-U at ¶19.

At the time of trial, the claimant was no longer working a second job transporting gutters to local building sites. The claimant admitted that the right foot burns were less severe and had “kind of disappeared.” 2025 IL App (4th) 240771WC-U at ¶21. However, the burns to his left foot were primarily on the top and side of the left foot. The size of the skin graft was approximately 8 inches by 4 inches in size. Id. The skin graft area was markedly different from the surrounding skin, with a shiny appearance and no hair growth. The right foot also exhibited circular burn areas on the top of the foot and ankle. The burn areas on the feet and left leg were shown to the arbitrator and counsel. Photographs of the burns were also submitted into evidence.

The arbitrator found that the claimant had sustained disfiguring injuries to his feet and his left leg and awarded 58 weeks of disfigurement benefits pursuant to §8(c) of the Workers’ Compensation Act, 820 ILCS 305/1, et seq. 2025 IL App (4th) 240771WC-U at ¶25. Specifically, the arbitrator awarded 10 weeks of disfigurement of the left leg, 3 weeks of disfigurement of the right foot, and 45 weeks of disfigurement of the left foot. Id. The five factors under §8.1(b) were not addressed as the arbitrator noted he was not awarding any permanency under that provision. The Commission affirmed and adopted the arbitrator’s decision in its entirety.

The employer appealed the Commission’s decision to the circuit court of Boone County, which held that the claimant was not entitled to benefits for disfigurement under §8(c) of the Act because that section does not authorize benefits for disfiguring injuries to the feet. The circuit court held that the foot was not covered under the list of body parts under §8(c). Relying on the medical dictionary definition of “leg,” the circuit court could not conclude that the foot would be considered part of the leg below the knee. The circuit court instead awarded permanent partial disability benefits under §8(d)(2) of the Act.

On appeal to the appellate court, the employer challenged the Commission award for benefits for disfigurement to the claimant’s feet under §8(c) because disfigurement of the foot was not listed as a compensable injury under the section. The employer further argued that benefits under §8(d)(2) applied only if the claimant had sustained serious and permanent injury “not covered by either sections 8(c) or 8(e).” 2025 IL App (4th) 240771WC-U at ¶28.The employer further argued that the claimant failed to present evidence of impairment of his foot, which would have entitled him to benefits under §8(e).

The key issue presented to the court was whether the foot is included in the definition of “leg below the knee” under §8(c) of the statute. 2025 IL App (4th) 240771WC-U at ¶34. The court had to ascertain and give effect to the intent of the legislature. The best indicator of the legislature’s intent was the plain language of the statute itself, which would be given its plain and ordinary meaning.

The court reviewed the definitions of “leg” under multiple sources including website citations to RxList, Healthline, the Meriam-Webster online dictionary, Britannica, and Wikipedia, noting that all of these sources included the foot as part of the leg. The court rejected the employer’s argument that the medical textbook definition, which defined the “leg” as a part of the body extending from below the knee to only the ankle, should be followed. The court noted that words in legislative enactments should be given their commonly understood meaning as used by the public as opposed to the meaning ascribed to the word by medical specialists. The various sources that the court had cited explicitly distinguished the common understanding of the word from the specialized medical terminology and included the foot as part of the leg.

The court addressed the employer’s argument that §8(e) of the Act showed that the legislature did not intend to define the foot as part of the leg because it listed them as separate body parts under that section. The court distinguished §8(e) from §8(c) as §8(e) covered impairment and not disfigurement, noting that impairment differs according to the body part that is injured, whereas disfigurement could be equally harmful wherever it occurs.

The court reversed the judgment of the circuit court of Boone County and reinstated the Commission’s decision awarding benefits for disfigurement of the left foot, right leg, and left leg under §8(c) of the Act.

For more information about workers’ compensation, see WORKERS’ COMPENSATION PRACTICE (IICLE®, 2023). Online Library subscribers can view it for free by clicking here. If you don’t currently subscribe to the Online Library, visit www.iicle.com/subscriptions.

FLASHPOINTS SPOTLIGHT

The 2025 Estate Planning Short Course is shaping up to be one of the most comprehensive learning and networking events of the year for estate planning attorneys. Taking place May 5–6 in Champaign (with a live webcast option) and May 19–20 in Chicago, this two-day program equips attendees with timely legal updates, practical strategies, and plenty of peer engagement opportunities.

A recent Cornered: Out of Court special podcast episode features Lorraine Cavataio of Sandberg Phoenix & von Gontard P.C. and Stacy Singer of The Northern Trust. Cavataio and Singer, co-chairs of the program planning committee, share what makes this year's course a "must" for estate planners. They discuss their experiences leading the program's development, what stood out during the planning process, and more.

With sessions covering everything from the Illinois Estate Tax and grantor trusts to the impact of artificial intelligence and psychological dynamics in probate litigation, this year’s agenda is packed with insightful topics. Attendees can choose between multiple breakout tracks tailored to litigation, administration, planning strategies, and professional responsibility topics. There are also sessions devoted to advanced techniques like leveraging trusts in lending, multi-state estate planning, and the nuances of GST and acronym trusts.

Whether you're attending to stay current with new laws and regulations, sharpen your strategic planning skills, or simply connect with fellow professionals, the Estate Planning Short Course offers a deep dive into the real-world challenges estate planners face, plus practical tools to help meet them head-on.